BUSINESS INSURANCE MADE EASY

The Coverage You Need, When You Need It

![]()

Choosing insurance for your business can be a daunting task. With so many options available, it is hard to determine what type of coverages you need.

Choosing insurance for your business can be a daunting task. With so many options available, it is hard to determine what type of coverages you need.

EM Ford can help. We offer insurance packages for all types of businesses, and we work with you to tailor coverage to your needs.

Whether your business is small or large, Main Street or rural America, making or selling, private, nonprofit or government entity – EM Ford has solutions to protect you, your business, and your people.

Experience includes, but is not limited to: Contractors, Retail, Manufacturing, Social Services, Nonprofits, Hospitality, Agribusiness, General Offices, Lessor’s Risk.

WHY CHOOSE US?

EM Ford offers insurance for people just like you – business owners. We offer top commercial insurance products at competitive prices. Let us focus on your insurance needs, so you can get back to taking care of your customers.

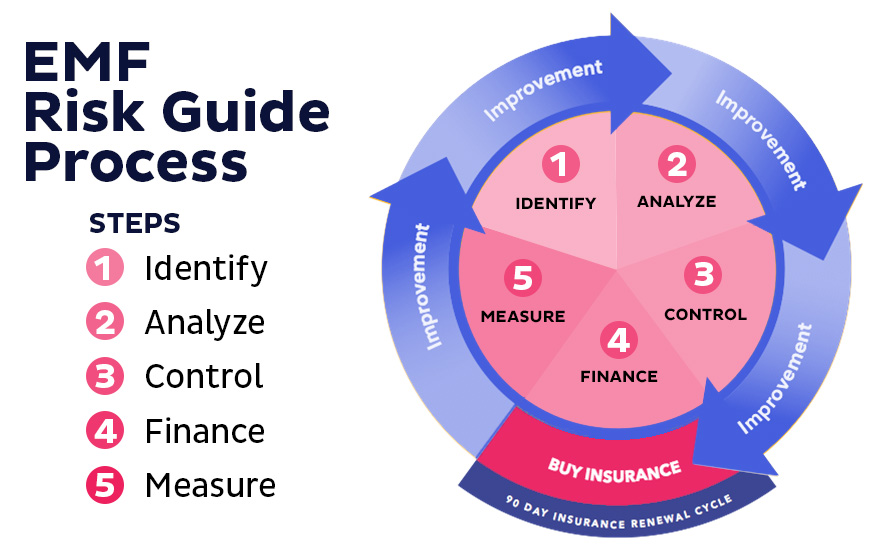

Each client will have the opportunity to go through our proprietary Five-Step EMF RiskGuide Process to help identify the coverages you and your business might need. Once we have determined your businesses unique exposures, we will come up with the best possible solution to control risks and provide the protection your business needs.

TYPES OF COVERAGE

General liability insurance policies typically cover you and your company for claims involving bodily injuries and property damage resulting from your operations, services and products while on or away from your premises. This is an essential coverage for any business operation.

Property insurance provides protection against most risks to property, such as fire, theft, wind, hail, and other causes of loss. Coverage is available for buildings, contents, equipment, inventory and loss of income caused by interruption of business from a covered cause.

Business or commercial auto insurance covers vehicles used by the business or organization. This can include vehicles owned, leased, hired, and borrowed. Coverage is available for liability exposures, as well as, damage to the vehicle.

Workers’ compensation is a state-mandated insurance program that provides benefits to employees who suffer job-related injuries and illnesses and includes a portion of lost wages resulting from injury. Each state has its own laws and programs for workers’ compensation that can often be combined into a single policy.

A type of liability coverage designed to protect traditional professionals (e.g.-accountants, attorneys, real estate brokers, consultants, doctors, designers) against liability incurred as a result of errors and omissions in performing their professional services.

A surety bond is a promise by a surety or guarantor to pay one party (the obligee) a certain amount if a second party (the principal) fails to meet some obligation, such as fulfilling the terms of a contract. The surety bond protects the obligee against losses resulting from the principal’s failure to meet the obligation.

Life insurance is a contract between an insurer and a policyholder in which the insurer guarantees payment of a death benefit to named beneficiaries upon the death of the insured.

Most notably, but not exclusively, cyber and privacy policies cover a business’ liability for a data breach in which the firm’s customers’ personal information, such as Social Security or credit card numbers, is exposed or stolen by a hacker or other criminal who has gained access to the firm’s electronic network.

Other Coverages to Consider

In addition to the types above, we also offer:

-

Umbrella

-

Director’s & Officers

-

Employment Practices Liability

-

Inland Marine

Email us if you require more information?

| Start Your Quote |

About EM Ford

Founded in 1925 in Owensboro, Ky., our philosophy has remained the same throughout: We provide quality products and personal attention.

We’re a full-service insurance agency who can handle your unique needs. With a staff of more than 35 and multiple locations, our service speaks for itself. We take the time to get to know you. We ask all the right questions so you get the right coverage. We work diligently to find the most competitive rates, the best coverage’s from a variety of top-level carriers.

You get affordable products based on your needs – not ours.

Visit our main site.

[DISPLAY_ULTIMATE_PLUS]